Watchlist for 2/11/15

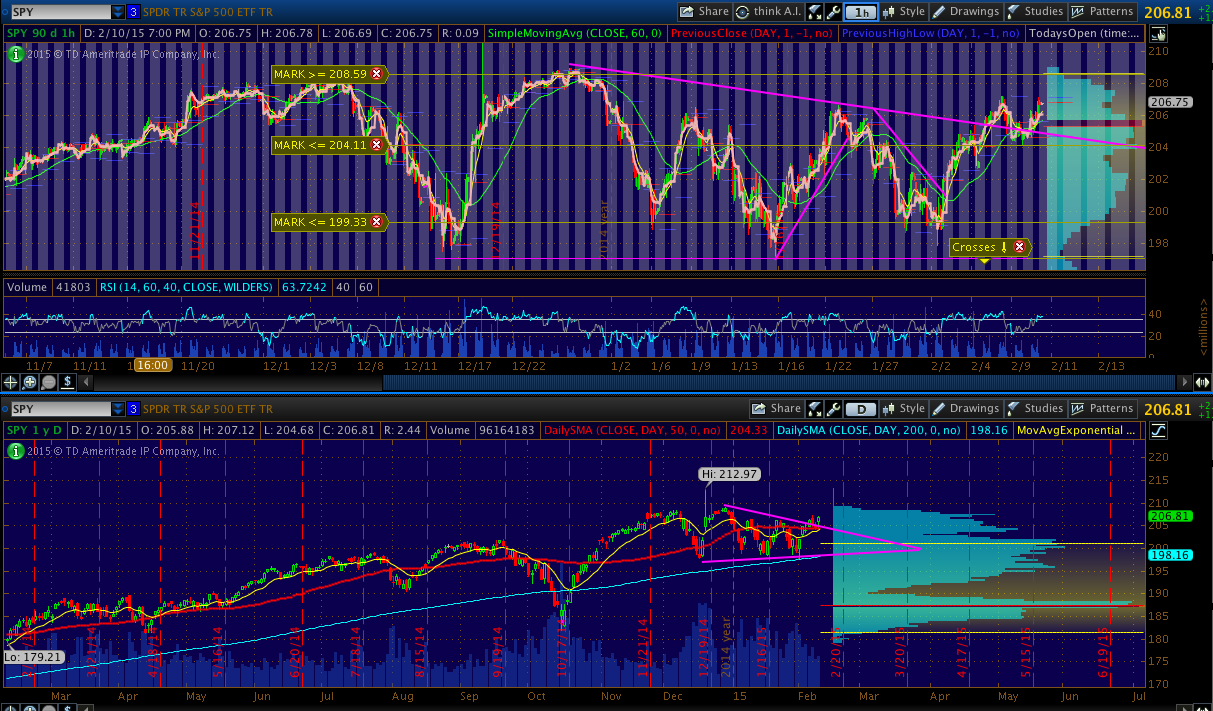

SPY seems to be breaking out of the descending triangle and VIX simmering down again. Whether this means that the bull market resumes I think is hard to say. More chop may be ahead. I'm not making calls on what the SPY is going to do per se, but I've been very cautious because I generally don't like what the elevated VIX may be signaling and the bull market is a good six years old so it may struggle to keep going.

AKAM - Earnings beat. Looking for gap up above 65.39 resistance and hold for breakaway gap play.

FSLR - Candidate for gap up tomorrow. 48.70 is a support level of interest. Next levels below are 45.50 and 44.20.

PAYC - Another earnings beat, looking for 30 support.

CYBR - Nice power candle. Looking for a second day continuation.

AMKR - I think this could grind higher above the 200DMA, but using the LOD 7.88 as a guide seems a little far. Would look for another level of support based on intraday if you want to play this.

DEPO - Nice reset back to near the 50DMA. Would use 17.25 as a risk if this dips near 18.

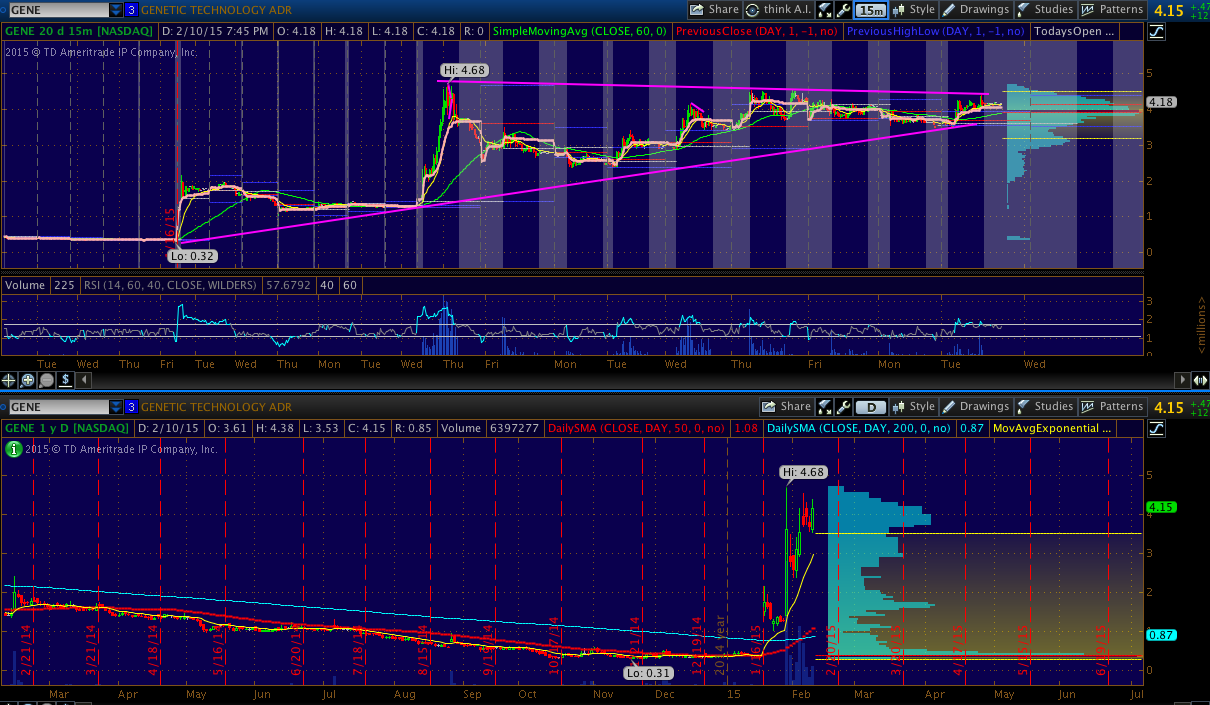

GENE - I heard through the grapevine that there were many forced liquidations of shorts today. Would consider short if it's available and the trend breaks.