SVXY - The Volatility Party is Over

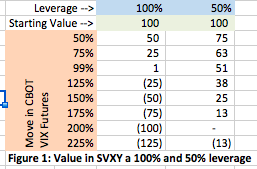

With the XIV exchange traded note gone, fans of trading inverse volatility will be looking to SVXY as an alternative. Unforunately on February 27, ProShares has announced that they will reduce the leverage in the SVXY product from 1 to 0.5. This means that whereas before SVXY tracked the inverse daily moves of the CBOT VIX futures month 1 and 2 contracts 1-to-1, a move in the VIX futures values will now result in half that percentage move in the SVXY. So let's say that there's a 5% down move in the VIX futures contracts, the SVXY would only change in value by a 2.5% up move.

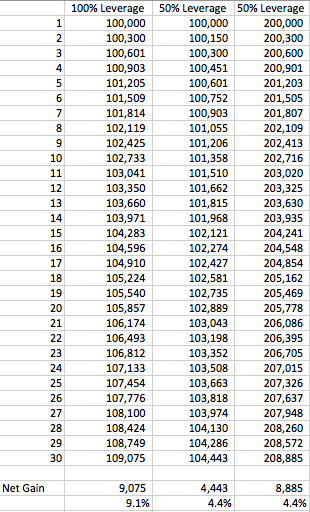

This change in leverage is a wise move for ProShares, the company issuing the SVXY security, because it means that an unprecedented move in volatility as we saw in early February is less likely to wipe out the fund's assets. But this is detrimental to investors looking to capitalize on contango and it's compounding effect on the security. Here's a chart I put together showing what sort of gains you would get if you invested $100,000 in SVXY and held for 30 days while contango was at 9% from the month 1 to month 2 rollover and the average value of the VIX contracts remained the same.

You actually get a little bit more than a 9% return because the investment compounds. At 50% leverage, you will make 4.4%, less than have the return. I tried experimenting with what would happen if you tried to compensate for the lower leverage by doubling your position size in SVXY. As you can see in the third column, it's not quite the same because there's less compounding and you fall short in nominal return.

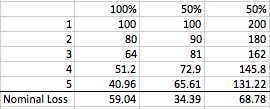

Doubling your exposure in SVXY to achieve the same return is dangerous because you have more capital at risk. Have a look at this chart depicting 4 consecutive days of 20% rise in VIX future contracts. At 100% leverage, SVXY starting at a value of 100 would decline 20% per day, ending the 4-day streak to end at a value of 40.96. At 50% leverage, the decline woudn't be quite as bad as it would end at 34.49.

But let's say you doubled your exposure, trying to replicate the same old returns. In this type of multi-day decline you would nominally lose more dollar amount (68.78) versus the 59.04 you would have lost with the old SVXY. That's about a 16.5% higher loss than you would have gotten before.

Conclusion

It seems that XIV/SVXY was too good to be true. Thanks to the demise of XIV and change in leverage of SVXY, never again will we have such a good vehicle for profiting from the VIX futures contango. Your best bet going forward for this kind of trade is to short VXX… but use position sizes wisely and hedge to protect your account from margin calls!