Swing Trading Watchlist for 10/2/14

I can't find many strong intraday setups. The market is very choppy and it's hard to say what tomorrow's open will do. This post is focusing on stocks that have pulled back to support areas and could have some good multi-day runs once the market bounces off support. For the S&P 500, support could be right here at about 1940, or it could be in the lower 1900s. Whichever the case, corrections like this are healthy for a bull market.

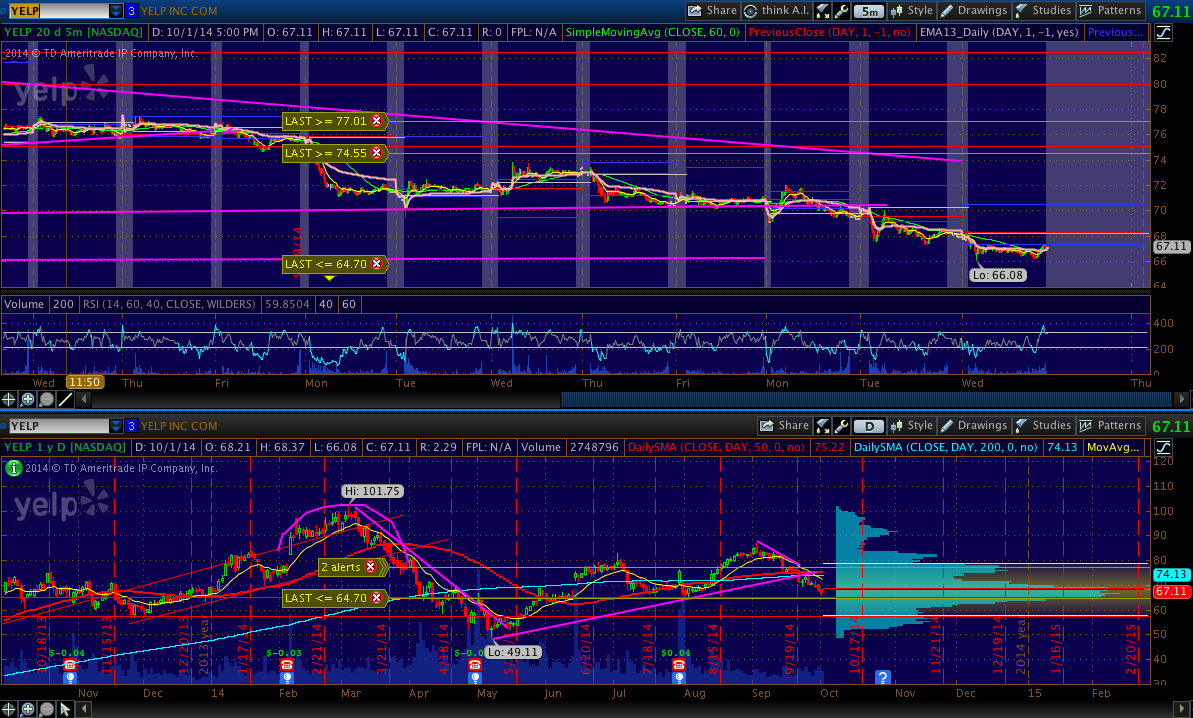

YELP - it defended 66 today. If 66 can still hold it may consolidate here below 70, or bounce back.

SUNE - pullback to the 200DM. Using 18 as a guide.

TSLA - inverted H&S today on the 5min. It looks like it wants to chop around here though so take profits quickly.

Z - Pullback to the 200DMA. Nice U-shape today with a volume increase.

ATK - Pull all the way back to a major support. Not my favorite setup because the patterns are not very well defined, but you can go long here for a good risk/reward.

AAL/UAL - The airlines are hurt not just by the correction, but headline risk about Ebola and radar fires in Chicago. Watching these stocks because they will be back soon, but it's not time to pull the trigger just yet. AAL had a nice double bottom on the intraday chart - good example for studying intraday trades.